In the midst of many golden moments in life, there comes a moment when we do not have money. Expenses are often incurred in life. When expenses come one by one, we keep taking them out of our salary, but there comes a time when all the expenses are tied to our heads together. At that time, the person does not see any other option; taking out a loan seems to be the only option. In such a situation, if your CIBIL score is good, then you get a loan very easily, but if your CIBIL score is bad, then how will you be able to fix it? That is why today we have brought important information like an increase in your CIBIL score online in 2024 for you.

Increase Cibil Score Online 2024

If your Cibil score is below 800, that is, you have a bad Cibil score, then you do not get a loan, so today we have written this article, Increase Cibil Score Online 2024, mainly for you. If you read this article once, then believe me, you will be able to get a loan from the bank very easily, even if you have a bad credit score. You should read this article till the end to know how and from where you will get a loan when your Cibil score is low. So, without any delay, let us give you detailed information in this regard.

2024 Increase Cibil Score check Overview

| Article Title | Increase Cibil Score online 2024 |

| Category | Cibil Score |

| Cibil Score category | Less than 500 bad cibil score

550 to 700 points good cibil score 700 to 900 cibil score very good cibil score |

| Tips for increase Cibil Score | Right time loan payment

To maintain less credit use rate Think first for new loan Check and update credit Report |

| Cibil Score check well known application | Paytm |

| Year | 2024 |

| Official website | www.cibil.com |

READ ALSO-

- GDS Post Office Bharti 2024, Apply Online

- Bankura District Court Recruitment 2024

- Bank Holiday June 2024, List, Calendar

- Bombay High Court Recruitment 2024

- ICICI Bank Recruitment 2024 Notification

Low Cibil Score Loan App 2024

You will find many such Low Cibil Score Loan Apps 2024 on the Play Store or any other app store that give you personal loans easily without guarantee, even with a low Cibil score. And nowadays, there are many such NBSC companies that give you loans only through Aadhar cards. But most of the companies prefer to give loans on the basis of a good credit score.

When you search on the Play Store, you will find many such Low Cibil Score Loan Apps 2024, which easily give you a loan by increasing your Cibil Score online in 2024.

Cibil Score New Rules 2024

Mainly, we would like to tell you that any bank or NBFC company that is giving you a personal loan checks your Cibil score. Nowadays, every company thinks that the Cibil score of the customer should be between 750 and 900.

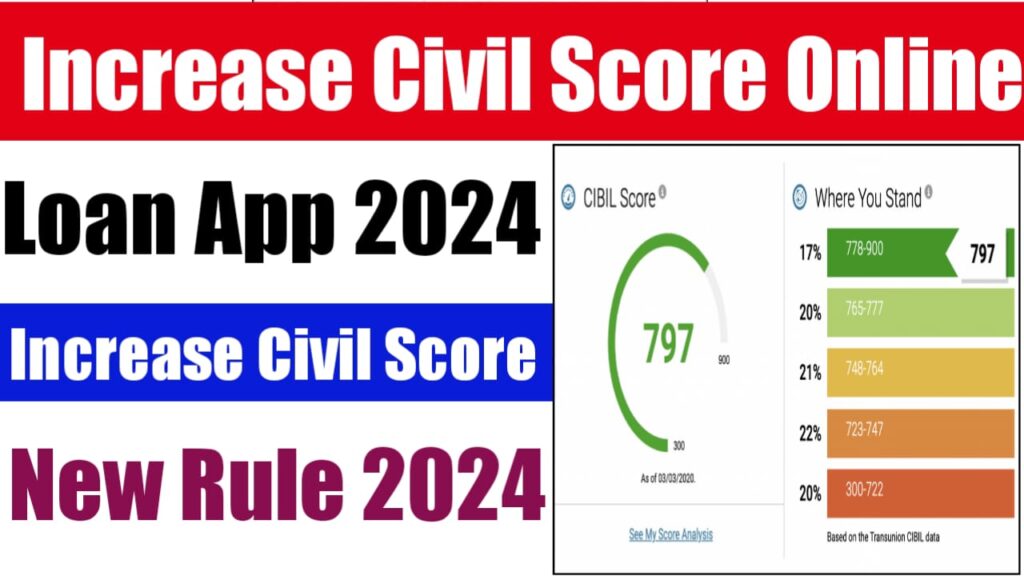

If you have this much CIBIL, then under Cibil Score New Rules 2024, you get a large amount in the form of a personal loan. To increase your Cibil Score online in 2024, you have to follow the terms and standards of the company. If your CIBIL score is less than 600, then we know it as a low CIBIL score. In this condition, you do not get a loan easily. According to Cibil Score New Rules 2024, if your CIBIL score is less than 500, then you do not get a loan under any circumstances.

Improve Cibil Score 2024

The CIBIL score ranges between 300 and 900 points. It is updated according to your one-year credit history. If your score is between 500 and 700 points, then your CIBIL is considered good. And if your CIBIL score is between 700 and 900 points, then it is considered very good. According to this, you can get a loan very easily. And you are easily provided with credit cards by banks and companies.

Your CIBIL gets spoiled due to many different reasons. If any loan is not repaid by you on time. If you do not maintain a minimum balance in your bank account or if you take many types of new loans in a very short time, If you do not deposit the credit card bill on time, etc.These are the reasons why your credit score gets spoiled.

Low CIBIL Score Loan App Benefits

New rules have been passed for increasing the Cibil Score online in 2024, keeping in mind the convenience of consumers. The Reserve Bank of India has announced new rules regarding Cibil Score in order to provide different types of facilities for its payments. In the new policy of the RBI, it has been said that lenders and financial institutions should provide details regarding their credit scores soon.

And if a customer faces any inconvenience, then he should ask the officials and get all the problems resolved within 30 days. And if any official fails to do so, then he has to pay compensation of ₹100 to his customers. Under Low CIBIL Score Loan App Benefits, these new rules have been implemented by the RBI in the interest of consumers.

Cibil Score Kaise Badhaye 2024

If you want to check your CIBIL score, then you can make sure to follow the steps given below.

- First of all, you will go to the official CIBIL website, www.cibilscore.in, and click on the registration option.

- Now you have to verify your identity by providing all the required documents.

- Now you have to access your credit information report, which includes your credit score.

- All the necessary information for Cibil Score Kaise Badhaye 2024 has been given in this article.

- After this, you have to analyze the report to identify areas for improvement, like late payments or high credit utilization.

Tips to Improve Your Credit Score

Here, I am going to tell you some easy ways. Through these easy methods, you can improve your CIBIL even more. And you can strengthen your financial position even more. Tips to Improve Your Credit Score Under Increase Cibil Score Online 2024, it may take some time because this score does not change overnight. First of all, you should pay the loan on time. For this, you should pay your loan on time without being careless.

You should always keep your credit usage rate low. That is, you should use less than 30 percent of your credit limit. If your credit limit is ₹20,000, then you should not keep more than ₹6,000 outstanding. Under Tips to Improve Your Credit Score, you should not close your old credit card. You should apply for a new loan only when there is an extreme need. You should keep checking your credit report from time to time.

Low Cibil Score Loan App List

- CASHe

- Money View

- Early Salary

- SmartCoin

- Home Credit

- LazyPay

- mPokket

- RupeeRedee

- StashFin

- PaySense

- MoneyTap

- Dhani

- India Lends

- KreditBee

- NIRA

- Flex Salary

- Bajaj Finserv

- PayMeIndia

- LoanTap

- Amazon

| For More Information Visit Kcedn |