The income tax department has announced their final date and the deadline regarding the opportunity to fill the Income tax return. Those taxpayers who will miss the original date to pay the tax can be able to pay it after the deadline that is till 31 July 2024. The time limit to file the belated return for the annual year 2024 is 31 July 2024. In this post we are going to tell you about the last date and penalties regarding ITR Filling Last Date to File ITR.

ITR Filling Last Date FY 2023-24

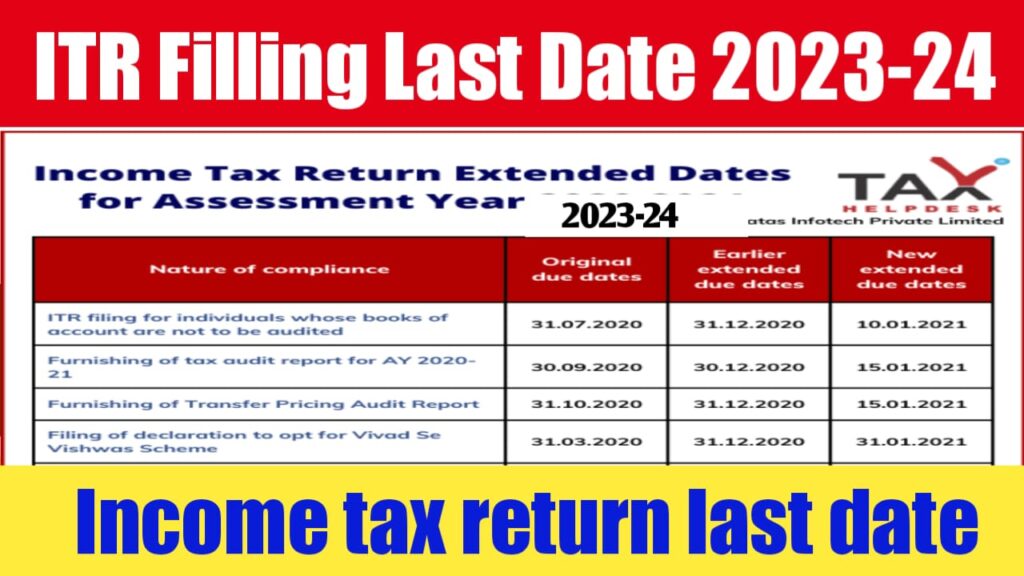

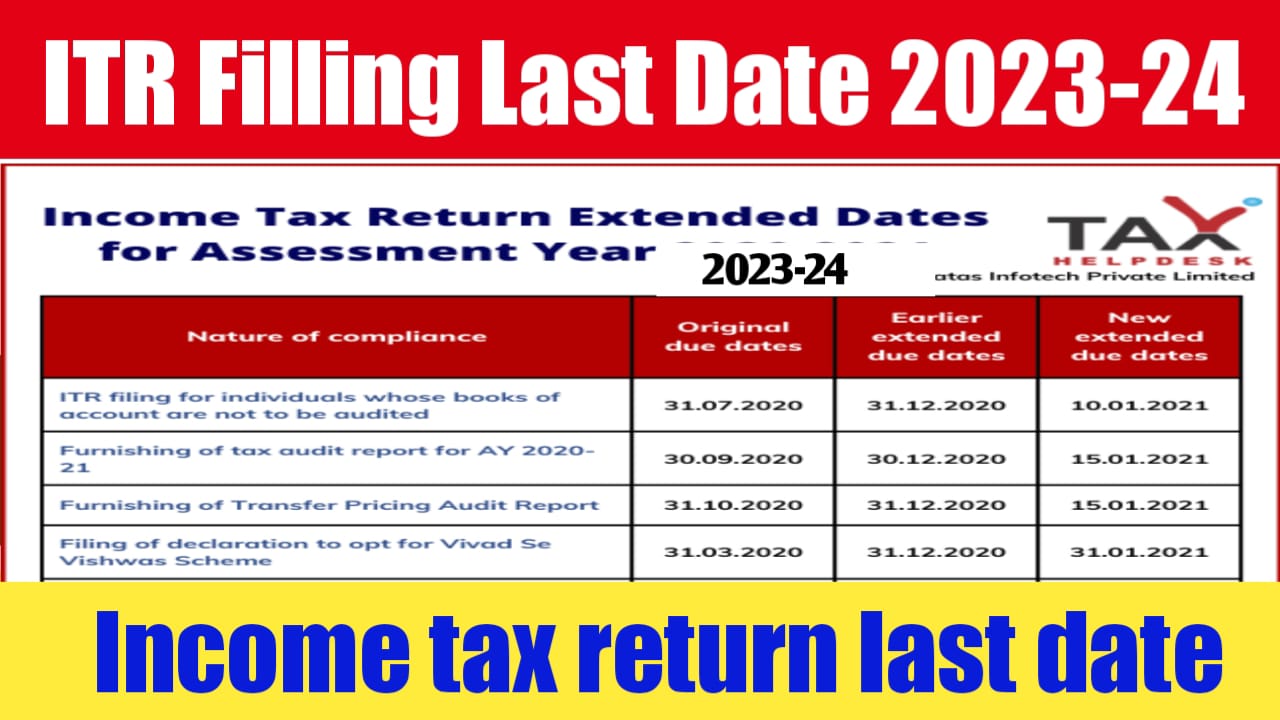

The last day to file the income tax return for the financial year 2023-2024 without late fees is 31 July 2024. Those taxpayers who want to file the income tax return after the due date will have to pay the interest or penalties under section 234A and under section 234F. The last date to fill the income tax return for the financial year 2023-2024 is 31 July 2024 however if you miss the due date you can also file a belated return before 31 December 2024.

So for the financial year and assessment year you can file the ITR before 31st December 2024. The return you will file in the upcoming year is for the income you earn in the financial year 2023-2024. The income tax return and between 1 April 2023 ended 31 March 2024. The assessment year is known as the Review year for the year 2023-2024. Where you file the returns and clear your returns by declaring all then comes and the other takes assessment.

ITR Filling Last Date FY 2023-24 Overview

| Title | ITR |

| Year | 2023-2024 |

| Category | Last Date |

| Last Date | 31 July 2024 |

| Due Date | 31 December 2024 (With penalty) |

| Income | 1 April 2023– 31 March 2024 |

READ ALSO-

- Central Bank of India Recruitment 2024

- NVS Recruitment 2024, Apply Online

- RRB NTPC 2024 Notification, Apply Online

- SSC CPO Admit Card 2024, Date, Link

- RRB ALP Admit Card 2024, Date

ITR Filling Last Date to File ITR

The income tax return filing is very important for the upcoming year. Then comes tax return online filing for the financial year 2023–2024 Has already started from 1 April 2024 and the last date to file the ITR for the financial year 2023-2024 is discussed. For the taxpayers if you submit your return after the deadline, you will be liable to pay the interest at the rate of 1% per month or Part month on the unpaid tax amount as per section 243 A.

Income Tax Return Filing Last Date to File ITR

In case any taxpayer is unable to pay the tax on time then in this case section 234F imposes 100 pieces of ₹5000 which shall be reduced to ₹1000 if your income is below five lakh rupees. There is also loss adjustment in case you have incurred losses from the sources like You Stock Market, properties, Real estate and any mutual fund you have the other option to carry them forward for the subsequent year of your income. This provision substantially reduces your tax liability in the future years.

ITR Tax Return Due Date 2023-2024

The income tax return due date 2023-2024 provisions of tensely reduces your text ability in the future years and you will not be allowed to carry forward if you have any losses in the financial year. Belated return is the return that if you miss the income tax return filing due date when you can file the return after the due date. This is called a belated return and you will still have to pay their lead in interest charges and you will not be allowed to carry forward any losses on future adjustment.

Income Tax Return last Date 2023-2024

Still if you miss the 31st December deadline due to the last guideline due to unavoidable reasons still you can find the updated income tax return subject to the conditions in specific. If you’ll get a salary you can simply upload your 16 forms and theatres will prepare your return automatically and help you finish e-filing within a matter of a few minutes.

ITR Filling Last Date 2024

Whenever we talk about the income tax return there are certain thanks for villages that need to be followed within a specific date such as filing income tax return and also paying advance tax on time. The due date for the payment of advance tax is given in the chat on their site.

ITR Filling Last Date for Individual

Overall more than 8.18 crore returns were filed for the financial year on 31 March 2024. For the financial you are indeed on 31 March 2024, The due date for the individuals to file their income tax return falls on 31 July 2024.

| For More Information Visit Kcedn |

This article is replete with grammatical mistakes and improper sentence formation thus making it more confusing. Please keep a tab on this aspect.

Dear sir

Please inform the details of penalty imposed for filing the returns after 31.07.2024.

Whether it may vary on amount.

Return to be filed will be without any taxes.

Regards